Aug 8, 2022

One of the first steps in wiping out debt is to pay off any credit card balances, since they usually carry the highest interest rates of any debt—today an average 15%. Here are 3 strategies for getting that balance paid off: 1. Pay it off with money from savings. If...

Jun 7, 2018

Are you one of the many people who get no rewards from their credit card? If so, take a few minutes and switch to card that offers rewards. If you have a credit score above 700, don’t settle for less than 1.5% rewards on your credit card. Get the rewards you want. If...

Nov 29, 2014

Gift cards can make nice gifts, but check the fees before buying them. Purchase fees may range from $2.95 to $6.95 or more. Also read the terms to see if it charges dormancy or maintenance fees, Three quarters of the cards charge fees up to $3 per month if the card is...

Oct 15, 2013

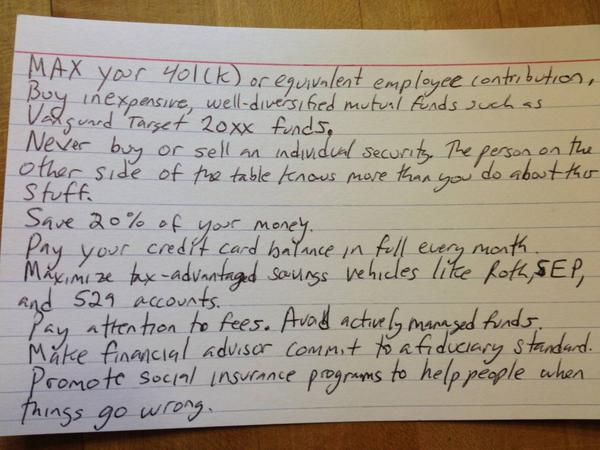

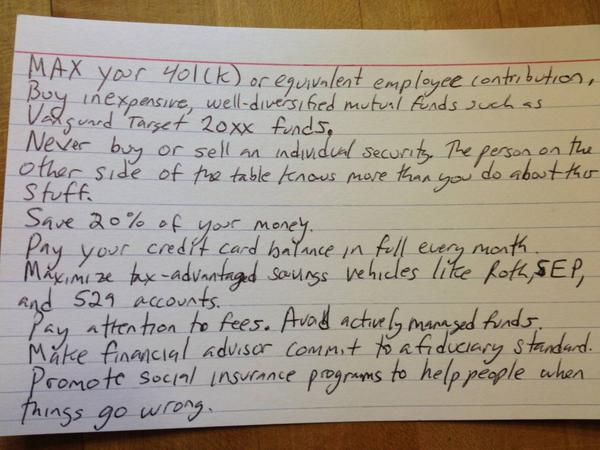

University of Chicago social scientist Harold Pollack says that everything you need to know about finances will fit on one index card. His advice is summarized below: MAX your 401(k) or equivalent employee contribution. Buy inexpensive, well-diversified mutual funds....

Jan 4, 2013

Avoid paying unnecessary fees to your bank every month. Check with your bank and see how you can configure your account to avoid ALL FEES. Don’t get trapped into, “Well, it’s only $10 a month.” They all add up! There may be a minimum balance requirement. Decide if you...

Nov 28, 2012

Ask and you might receive. When Money magazine called 10 credit card lenders and merely asked them to lower their interest rates, 3 out of 10 did! If you have a car loan, ask if they can reduce the rate of that as well. This could also work in other areas of banking....

Sep 17, 2012

Many people are finding that they can go cashless, since you can now pay for just about everything with debit cards, credit cards, or an app on your mobile phone. 40% of adults have gone cashless for an entire week. Although being cashless may be convenient, it can...

Jul 15, 2012

Money magazine (May 2012, p. 12) offers the following advice for college seniors: “Don’t expect a job to come to you. Get out there and network with people.” –Matthew Doyle “Buy a used fuel-efficient car and brown-bag your lunch” –Christine Deloach “Always, always,...