Gift cards can make nice gifts, but check the fees before buying them.

Gift cards can make nice gifts, but check the fees before buying them.

Purchase fees may range from $2.95 to $6.95 or more. Also read the terms to see if it charges dormancy or maintenance fees, Three quarters of the cards charge fees up to $3 per month if the card is unused.

All-purpose cards issued by banks tend to charge more fees than store-branded cards.

The benefit of general-purpose cards offered by banks and credit card companies is that they can be used anywhere, but because of the fees, you may be better off giving cash.

For example, we purchased a general-purpose Visa gift card for $30. It had a $2.95 purchase fee. Although it said “No Fees After Purchase” (meaning no monthly recurring fees), there was a $4.95 activation fee that would be deducted from the $30 value on the card. Therefore, our $30 card actually cost $37.90. We wonder if it would have been better just to give the $30 in cash.

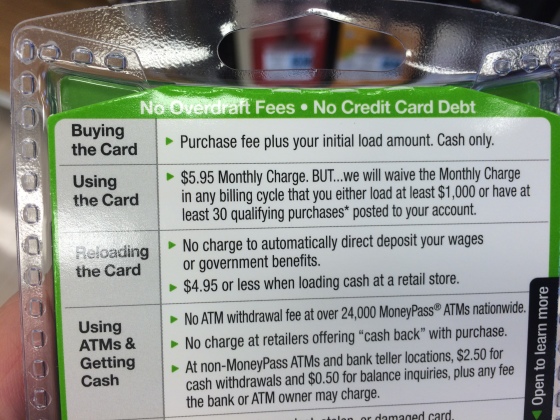

Along with gift cards, you may also find “prepaid credit cards” which may charge higher fees. Below is an example of a prepaid card that, in addition to the $5.95 purchase fee, it deducts $5.95 a month off the card unless you reload it with $1,000 in a given month or have 30 monthly purchases.