Nov 28, 2025

This Black Friday, skip the typical gadgets and give the priceless gift of digital memories! Turning physical photos into secure, digital archives saves them from time, degradation, and disaster. This is your chance to stop worrying about lost history and start...

Nov 28, 2025

Your paper photos and slides are fading over time. Your videocassettes are degrading and becoming fuzzy. What if your home is flooded or the box of memories is lost? Even digital records on CDs or computer floppy disks will degrade over time. Do you even still have a...

Oct 15, 2013

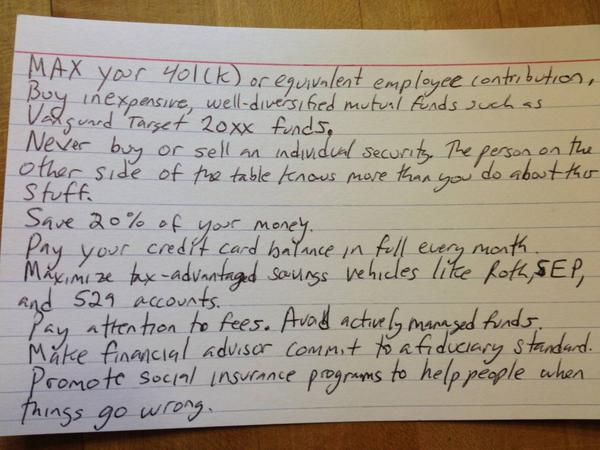

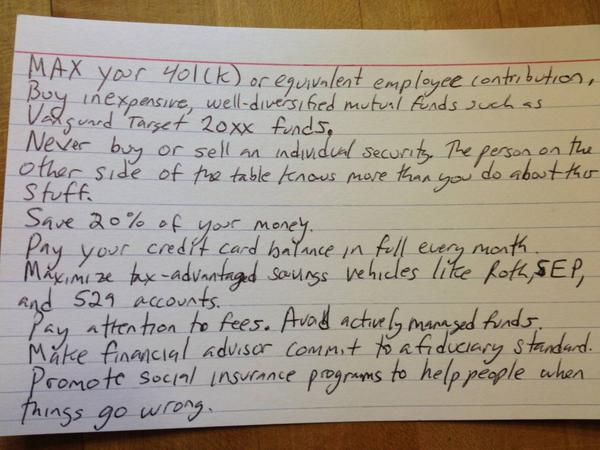

University of Chicago social scientist Harold Pollack says that everything you need to know about finances will fit on one index card. His advice is summarized below: MAX your 401(k) or equivalent employee contribution. Buy inexpensive, well-diversified mutual funds....

Mar 5, 2013

With interest rates on savings accounts near zero, what do you do with your money in savings? Here are 2 ideas: 1. Get a high-yield checking account. You can earn nearly 20 times the rate of the average savings account and also avoid typical checking account fees....

Feb 18, 2013

Given the volatile nature of the world we live in, it is prudent to prepare yourself with a basic supply of food, other necessities, and money—in case of an emergency or a change in life situation. Emergencies or Life Changes When you hear “emergency,” you probably...

Feb 15, 2013

In 1995, workers said they expected to retire at age 60 on average. In 2012, the average worker expects to retire at 66. Benefits of postponing retirement: First, you can nearly double your annual Social Security payouts if you delay retirement from age 62 to 70. In...

Feb 8, 2013

1. Have money automatically deposited to your 401(k), savings account, or college savings account. This is a more sure way to build your savings. Although fewer than 40% of savers do this, it is easier to exercise self-control if your money is less available. 2. Each...