May 30, 2021

With few exceptions, a home is the most valuable asset most of us will purchase in our lifetime. However, too many families in the United States purchase a home that stretches them financially beyond what is needed or what is wise. Although 30-year mortgages have...

Jan 2, 2019

Personal finance mobile apps are a handy, easy, and effective way to improve your budgeting skills at the flick of a fingertip, and without an Excel spreadsheet or yellow legal pad in sight. Want to track your spending in real time? A mobile phone budgeting app can do...

Oct 15, 2013

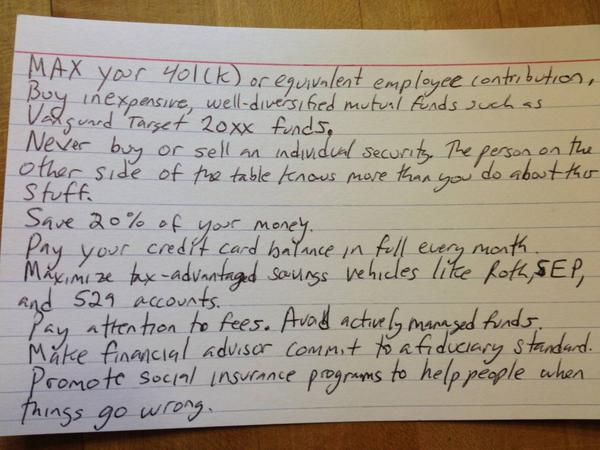

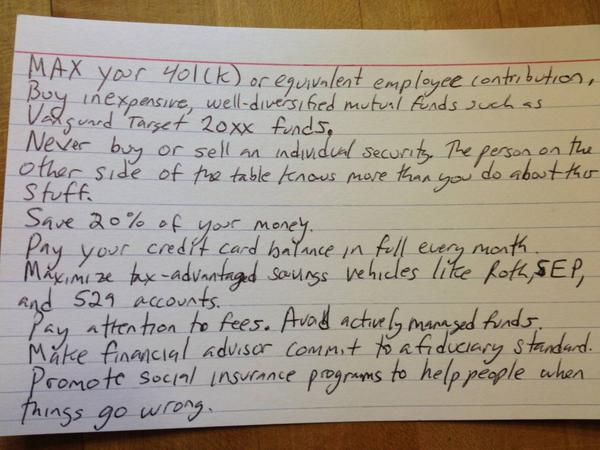

University of Chicago social scientist Harold Pollack says that everything you need to know about finances will fit on one index card. His advice is summarized below: MAX your 401(k) or equivalent employee contribution. Buy inexpensive, well-diversified mutual funds....

Apr 5, 2013

It’s a fact of life that we’re all going to die at some point. While it’s not something you probably want to think about, you can make things a lot easier on yourself (and your family) if you get everything in order now. Here are 7 simple steps to...

Apr 2, 2013

Tired of the fees, low interest, or bad service at your bank? The infographic below shows how to switch to a new bank.

Mar 25, 2013

Today with online banking and mobile apps, many people no longer bother to balance or reconcile their checking accounts. But even though bank errors are rare, there are still some good reasons to at least review your account monthly: See how much you’ve spent...

Jan 30, 2013

Before you sign a contract for a gym membership, read it carefully and understand what you are signing. Complaints about membership contracts are way up across the country. In 2012 in Utah, for example, the Better Business Bureau of Utah received 330 complaints...