Jul 18, 2023

Online scams come in various forms, and older adults are one of the most targeted groups on the internet. It’s important to know that not everything you see online is true, and some emails and websites will have malicious intent. Seniors should learn about best...

Aug 8, 2022

One of the first steps in wiping out debt is to pay off any credit card balances, since they usually carry the highest interest rates of any debt—today an average 15%. Here are 3 strategies for getting that balance paid off: 1. Pay it off with money from savings. If...

May 30, 2021

With few exceptions, a home is the most valuable asset most of us will purchase in our lifetime. However, too many families in the United States purchase a home that stretches them financially beyond what is needed or what is wise. Although 30-year mortgages have...

Apr 6, 2020

The popular book Talk About Saving Money: How to Save on Food, Utilities, Car Expenses, Mortgage, and Health Care is being given away by the author to help people learn how to save money on everyday expenses. Just pay $2.95 shipping. Very practical book helps...

Jan 2, 2019

Personal finance mobile apps are a handy, easy, and effective way to improve your budgeting skills at the flick of a fingertip, and without an Excel spreadsheet or yellow legal pad in sight. Want to track your spending in real time? A mobile phone budgeting app can do...

Jun 7, 2018

Are you one of the many people who get no rewards from their credit card? If so, take a few minutes and switch to card that offers rewards. If you have a credit score above 700, don’t settle for less than 1.5% rewards on your credit card. Get the rewards you want. If...

Jul 24, 2016

The end of the year is a good time to remember to get your free credit report. Although the Fair and Accurate Credit Transaction Act of 2003 gives you the right to a free credit report once a year, only 4% of us get it. You can claim your report once every 12 months...

Dec 23, 2015

Find out which credit cards are best for rewards (cash back, airline miles, points, etc.). Read the article “The 6 Best Credit Cards For Rewards In 2016.”

Sep 5, 2015

Few things can make you feel more out of control than having payments due on multiple credit cards and loans and not enough money to pay them. It can be emotionally and financially draining. Certainly, the solution is to not acquire too much debt in the first place,...

Aug 30, 2015

It is now cheaper to buy homes than to rent them in 98 of the top 100 metropolitan areas. And most markets are expected to appreciate in the next few years. If you have good credit, this is the best time in 40 years to buy. Want to trade up? Even though the buyer of...

Oct 15, 2013

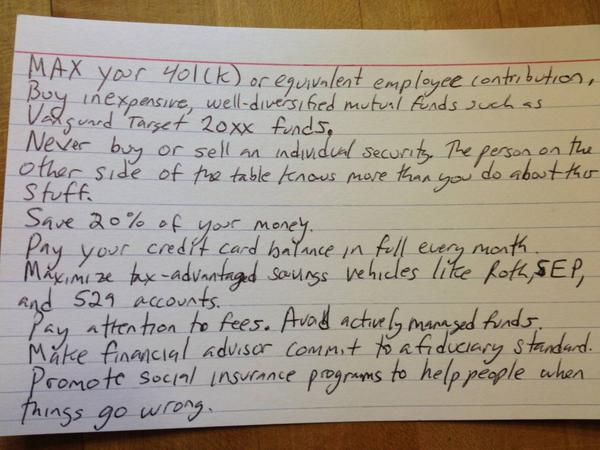

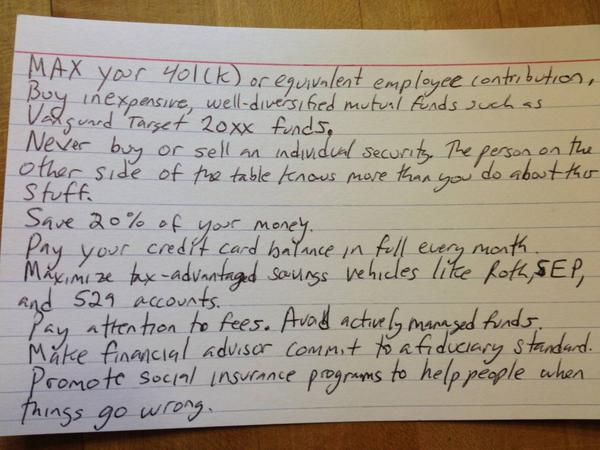

University of Chicago social scientist Harold Pollack says that everything you need to know about finances will fit on one index card. His advice is summarized below: MAX your 401(k) or equivalent employee contribution. Buy inexpensive, well-diversified mutual funds....

Oct 1, 2013

Most Americans are adventure junkies and love to live on the edge. But when it comes to financial management, living on the edge can actually complicate your financial state. As a matter of fact, 49% of Americans don’t have an emergency fund in these tough economic...

Aug 30, 2013

The perpetrators of scams, fraud, and other forms of theft never seem to take a break from trying to steal our money and personal information, despite our best efforts to protect ourselves. There are, however, simple steps you can take to significantly reduce your...

May 9, 2013

The US Social Security Office has stopped its previous practice of mailing statements to most workers. However, you can go online to see your earnings history and estimated benefits. See ssa.gov/mystatement.

Apr 19, 2013

Every year, millions of dollars in bank accounts, stock certificates, checks, insurance checks, bonds dividends, and security deposits are turned over to state governments because the owners cannot be located. Some of this money could belong to you! Companies are...